Maximize Your Year-End Savings: How Clinicians Can Use Section 179 for SurgiTel Equipment

As the end of the year approaches, many clinicians look for smart ways to invest in their practice while reducing taxable income. One powerful opportunity often overlooked is the Section 179 tax deduction — a U.S. tax incentive that allows businesses, including dental and medical practices, to deduct the full purchase price of qualifying equipment in the year it is placed in service.

If you’ve been considering upgrading your SurgiTel loupes, LED headlights, or ergonomic seating, now may be the best time to take advantage of this deduction.

What Is Section 179?

Section 179 of the IRS Tax Code allows business owners to deduct the full cost of qualifying equipment (instead of depreciating it over several years) when it is purchased and used primarily for business.

In 2025, the maximum deduction limit is $1,250,000, and the deduction begins to phase out once total qualifying equipment purchases exceed $3,130,000 (IRS Publication 946).

This incentive was designed to encourage small and mid-sized businesses — including healthcare practices — to invest in modern tools that enhance productivity, safety, and patient outcomes.

Does Clinical Equipment Qualify?

Yes — in most cases, SurgiTel loupes, headlights, and stools can qualify for the Section 179 deduction, provided they meet the following conditions:

- The equipment is tangible property used primarily for business purposes (more than 50% of the time).

- The purchase is made and placed in service during the same tax year.

- The deduction does not exceed your business’s taxable income for the year.

Because loupes and headlights are essential clinical instruments, they typically qualify as deductible medical equipment. (Henry Schein Financial Services, 2024)

Example: Immediate Savings for Clinicians

Let’s say you purchase a pair of SurgiTel loupes and a digital headlight system totaling $5,000 in 2025.

If your practice meets the Section 179 requirements, you could deduct the entire $5,000 on your 2025 taxes — instead of depreciating that cost over five years.

Depending on your effective tax rate, that could mean $1,000 to $1,500 in immediate tax savings.

Why It Matters for Ergonomics and Clinical Performance

SurgiTel products are designed to enhance clinician comfort, posture, and long-term health — helping to prevent work-related musculoskeletal disorders (MSDs).

Using Section 179 to invest in ergonomic equipment not only offers a tax benefit but also supports sustained clinical performance and reduced injury risk.

Many clinicians use the year-end period to invest in upgrades that improve both financial efficiency and daily comfort in the operatory.

How to Take Advantage of Section 179

- Consult your tax professional. They can confirm your eligibility and the amount you can deduct.

- Purchase and place in service qualifying equipment (like SurgiTel loupes or headlights) before December 31, 2025.

- Keep documentation — including invoices, proof of payment, and dates the equipment was placed in service.

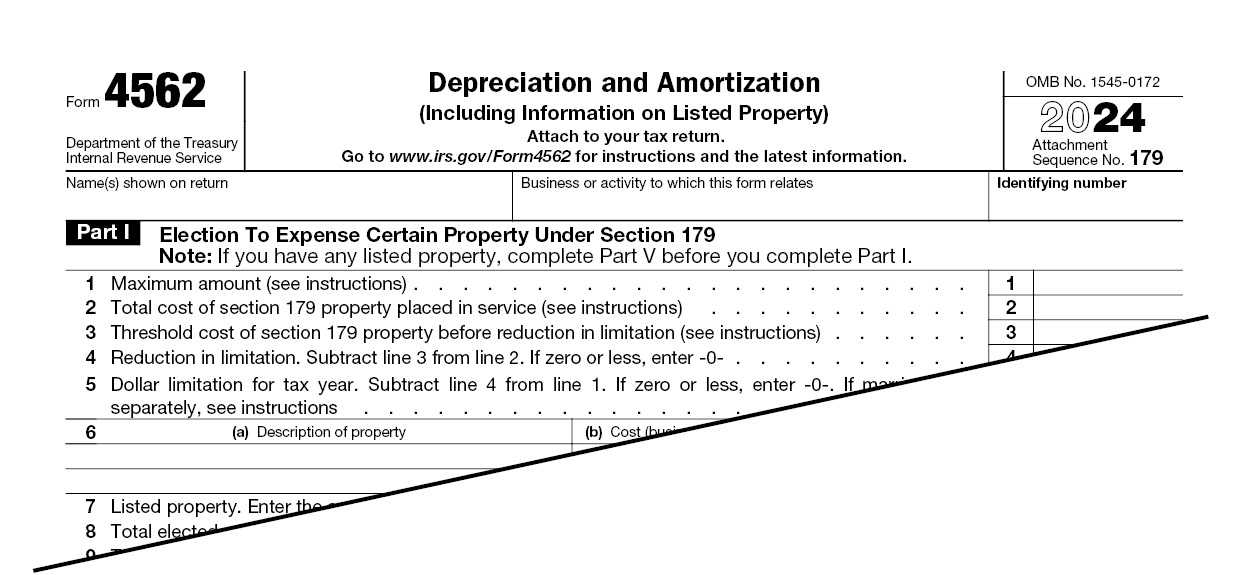

- File IRS Form 4562 with your tax return to claim your Section 179 deduction.

Helpful Resources

- IRS Publication 946 – How to Depreciate Property

- Henry Schein Financial Services – Section 179 for Medical Practices

- Medical Economics – Tax Savings Strategy for Medical Practices

- IRS Publication About Form 4562

Final Note

SurgiTel does not provide legal or tax advice. The information above is for educational purposes only. Clinicians should consult their accountant or tax advisor to confirm eligibility and potential savings under Section 179.

Invest in your health, performance, and savings this year.

Contact your local SurgiTel representative to learn more about our year-end promotions and how your purchase may qualify for a Section 179 deduction.